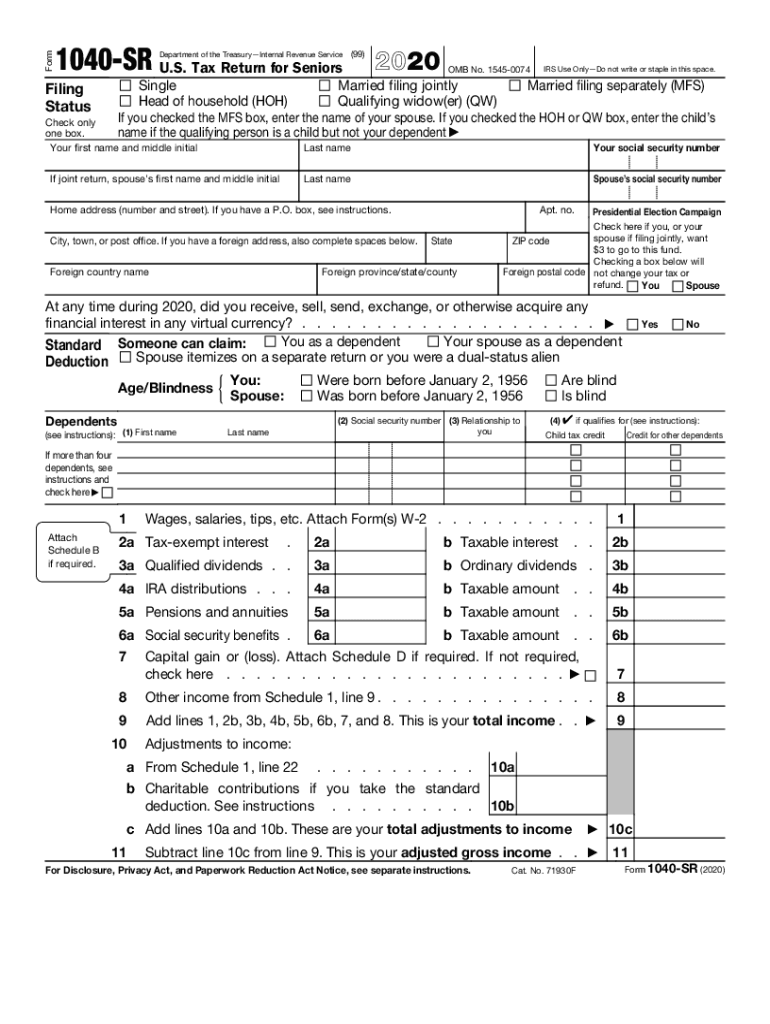

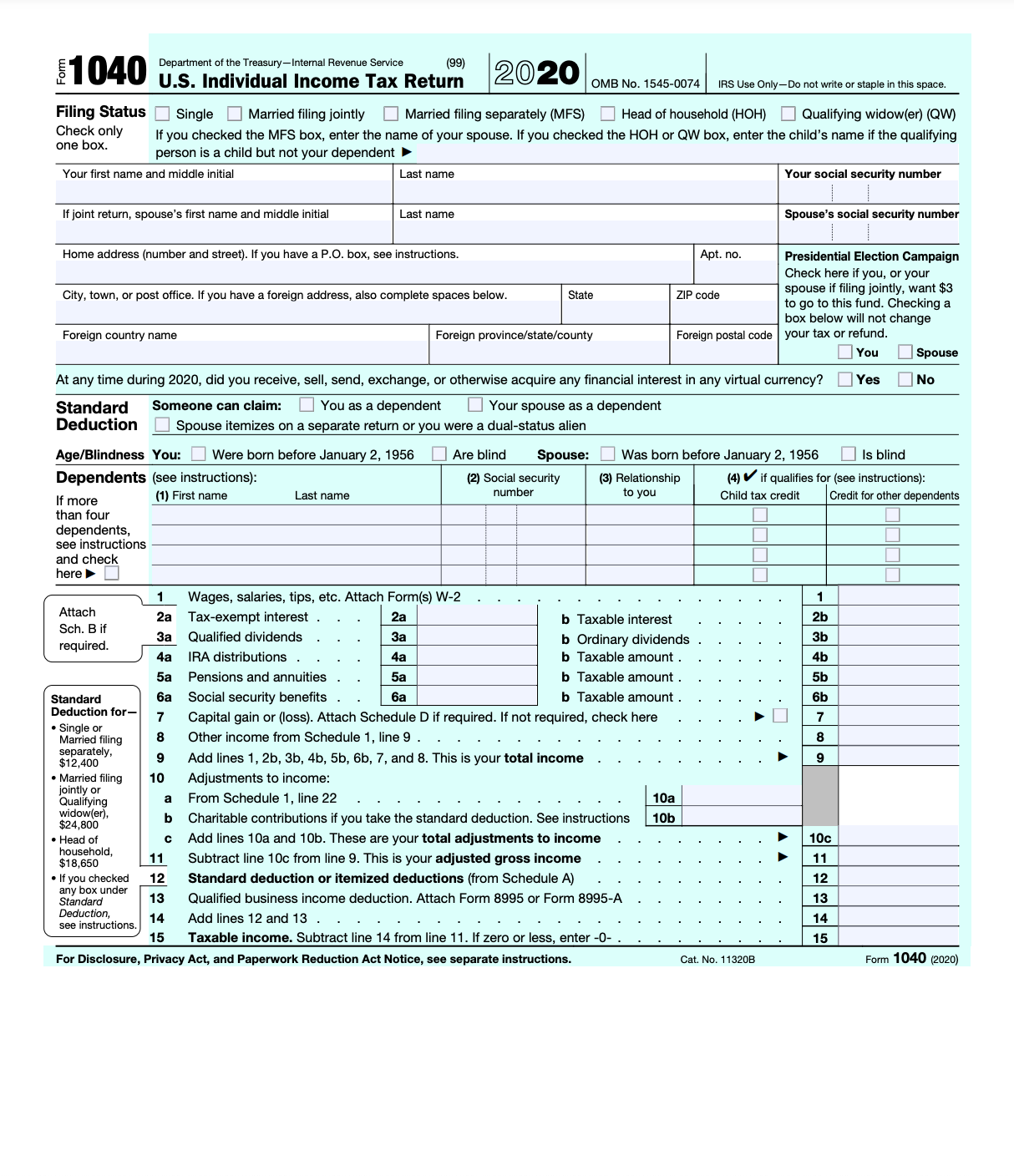

You should do this after you have completed the rest of the form. The final part of the first page requires you to sign and then write in your occupation.

:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png)

You will also see a box that you should check to certify that you, your spouse (if you file jointly) and all of your dependents had qualifying health care coverage or a coverage exemption for all of the year. There is a box beside each dependent that you can check if you’re claiming the child tax credit or credit for other dependents. If you’re filing jointly, you also need to add the name and SSN of your spouse.įilers with dependents need to add the names, SSNs and the relationship (to the filer) of each dependent.

This includes your name, address, Social Security number (SSN) and filing status. The first page asks for your basic personal details. The only exception to this is Form 1040NR, which nonresident aliens use. However, these forms are no longer in use because of the tax plan that President Trump signed into law in late 2017. Previously, filers with simple tax situations could use the 1040EZ or 1040A. Individual Income Tax Return.” As of 2019, there is only one version of the Form 1040, which means all tax filers must use it. The full name the IRS gives to Form 1040 is “Form 1040: U.S. For forms and publications, visit the Forms and Publications search tool.Form 1040 Defined for the U.S. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool.įorms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google™ translation application tool. For a complete listing of the FTB’s official Spanish pages, visit La esta pagina en Espanol (Spanish home page). These pages do not include the Google™ translation application. We translate some pages on the FTB website into Spanish. If you have any questions related to the information contained in the translation, refer to the English version.

Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Consult with a translator for official business. This Google™ translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only.

0 kommentar(er)

0 kommentar(er)